Standard and Poor's 500 hits 6,900 for first time

Lola Evans

29 Oct 2025, 01:39 GMT+10

- The NASDAQ Composite climbed 190.04 points, or 0.80 percent, to close at 23,827.49.

- The Dow Jones Industrial Average gained 161.78 points, or 0.34 percent, to settle at 47,706.37.

- The Standard and Poor's 500 posted a solid advance, rising 15.72 points, or 0.23 percent, to finish at 6,890.88.

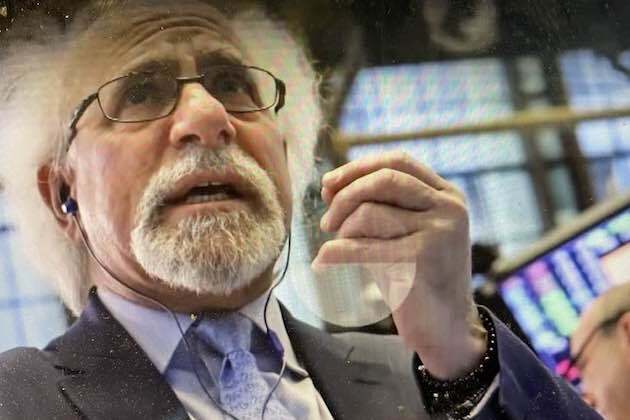

NEW YORK, New York - U.S. stock indices closed firmly in positive territory on Tuesday, with technology shares leading the charge as investor optimism around corporate earnings and the economic outlook fueled a broad-based rally. The Standard and Poor's 500 topped the 6,900 level for the first time, closing just below that level.

The tech-heavy NASDAQ Composite (^IXIC) was the day's standout performer though, climbing 190.04 points, or 0.80 percent, to close at 23,827.49. The strong gain reflected renewed confidence in the growth prospects of the technology sector.

The benchmark S&P 500 (^GSPC) also posted a solid advance, rising 15.72 points, or 0.23 percent, to finish the session at 6,890.88.

The blue-chip Dow Jones Industrial Average (^DJI) joined the rally, gaining 161.78 points, or 0.34 percent, to settle at 47,706.37.

Analysts Point to Resilient Economy

"Today's action, particularly the leadership from the Nasdaq, suggests the market is shaking off recent volatility and focusing on solid fundamentals," said a market strategist. "The momentum is broad-based, which is a healthy sign."

The upbeat mood pushed the Dow and S&P 500 to close near their session highs, indicating strong buying interest into the final bell. Investors are now looking ahead to key economic data and further corporate earnings reports to sustain the positive momentum.

U.S. Dollar Shows Mixed Performance as Yen Nears Key Level

The U.S. dollar traded in a mixed fashion against its major rivals on Tuesday, strengthening against the Japanese yen but softening against the euro and commodity-linked currencies amid shifting risk sentiment.

A key focal point for traders was the yen, which continued to weaken. The USD/JPY pair rose to 151.99, with the dollar gaining 0.57 percent against the Japanese currency. This move brings the pair close to the 152 level, a point that has historically drawn verbal or physical intervention from Japanese monetary authorities.

In contrast, the euro found some footing. The EUR/USD pair advanced to 1.1661, a gain of 0.15 percent for the common currency. The British pound, however, bucked the trend in Europe, with GBP/USD falling 0.41 percent to 1.3280.

The U.S. dollar also lost ground against its Canadian counterpart. The USD/CAD pair declined 0.35 percent to 1.3941. Similarly, the dollar softened against the Swiss franc, with USD/CHF dipping 0.30 percent to 0.7929.

Commodity Dollars Gain on the Day

The Australian and New Zealand dollars, often sensitive to global growth expectations, both posted solid gains. The AUD/USD pair was a standout, rallying 0.50 percent to 0.6588. The NZD/USD pair also climbed, rising 0.28 percent to 0.5785.

Market Analysts Weigh In

"The market is clearly testing the resolve of the Bank of Japan," said one currency strategist. "The steady march in USD/JPY is the dominant story, but the resilience in the commodity bloc suggests investors aren't fully in a risk-off mode just yet."

Traders are now closely monitoring for any official commentary from Japan regarding the yen's weakness, which could trigger significant volatility in the sessions ahead.

Global Stock Markets Show Mixed Performance as FTSE 100 Climbs While European and Asian Indices Struggle

Global stock markets delivered a mixed performance on Tuesday, with the UK's FTSE 100 notching a solid gain while major European and Asian benchmarks largely retreated amid lingering economic concerns.

Canada's main stock index mirrored the positive sentiment on Wall Street. The S&P/TSX Composite Index (^GSPTSE) advanced 143.92 points, or 0.48 percent, to close at 30,419.68, lifted by strength in its heavyweight energy and materials sectors.

In London, the FTSE 100 (^FTSE) was a solid performer, closing at 9,696.74, a gain of 42.92 points or 0.44 percent. The index managed to hold near its session high of 9,727.09.

The picture was less rosy on the European mainland. Germany's DAX (^GDAXI) edged down to 24,278.63, dipping 0.12 percent, while France's CAC 40 (^FCHI) fell 22.60 points, or 0.27 percent, to finish at 8,216.58. The broader EURO STOXX 50 (^STOXX50E) also slipped, losing 0.12 percent to close at 5,704.35.

Other European indices saw more pronounced declines. Belgium's BEL 20 (^BFX) was a notable laggard, dropping 46.11 points, or 0.92 percent, to settle at 4,948.49.

In Asia and the Pacific, trading was mostly negative. Hong Kong's Hang Seng Index (^HSI) fell 0.33 percent to 26,346.14, and Australia's S&P/ASX 200 (^AXJO) declined 43.10 points, or 0.48 percent, to close at 9,012.50. The broader All Ordinaries (^AORD) index fell 0.60 percent to 9,295.80.

Japan's Nikkei 225 (^N225) pulled back from recent highs, falling 293.14 points, or 0.58 percent, to end the session at 50,219.18.

Selective Gains in a Sea of Red

Despite the generally negative tone, a few key indices managed to eke out gains. Singapore's STI Index (^STI) advanced 0.23 percent to 4,450.36, and New Zealand's S&P/NZX 50 (^NZ50) inched up 0.08 percent to 13,402.66.

In Africa, the Johannesburg All Share (^JN0U.JO) posted a strong gain of 1.62 percent, closing at 6,420.19.

Other Major Asian and Middle Eastern Markets

-

India's S&P BSE Sensex (^BSESN) dipped 0.18 percent to 84,628.16.

-

South Korea's KOSPI (^KS11) fell 0.80 percent to 4,010.41.

-

Taiwan's TWII index closed at 27,949.11, down 0.16 percent.

-

Israel's TA-125 (^TA125.TA) declined 0.94 percent to 3,279.25.

- Egypt'sEGX 30 (^CASE30)rose0.37 percentto38,304.90

-

Indonesia's IDX Composite (^JKSE) fell 0.30 percent to 8,092.63.

-

Malaysia's KLSE (^KLSE) also dropped 0.30 percent, ending at 1,613.56.

-

The Shanghai Composite (000001.SS) closed at 3,988.22, down 0.22 percent.

Investors are now looking ahead to key economic data and central bank commentary for further direction on the health of the global economy.

Related stories:

Monday 28 October 2025 | Wall Street continues to soar, rally gains momentum | Big News Network.com

Friday 24 October 2025 | Dow Jones closes above 47,000 for first time in history | Big News Network.com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Africa Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Africa Leader.

More InformationInternational

SectionBritain cracks down on illegal workers as arrests jump 63%

LONDON, U.K.: Britain has intensified its crackdown on illegal working, making 63 percent more arrests over the past year as authorities...

Israel Launches Deadliest Strikes in Gaza Since Ceasefire Began

Israel has launched its deadliest strikes on Gaza since the United States-brokered ceasefire took effect nearly three weeks ago, saying...

ATC shortage disrupts flights amid ongoing US shutdown

WASHINGTON, D.C.: A shortage of air traffic controllers caused more flight delays across the country at the start of the week, as controllers...

Five rescued after twin crashes involving aircraft on USS Nimitz

WASHINGTON, D.C.: A fighter jet and a helicopter from the aircraft carrier USS Nimitz both crashed into the South China Sea within...

Paris police arrest suspects in $102 million Louvre jewel theft

PARIS, France: Two men have been arrested in connection with the theft of crown jewels from the Louvre Museum in Paris, officials said...

Washington struggles to manage narrative on Israel

On October 4th, 2025, in an interview with Axios, President Trump stressed that one of the main goals behind his Gaza plan was to restore...

Business

SectionFed lowers interest rates, stocks close mixed, dollar jumps

NEW YORK, New York - U.S. stocks stopped for breath on Wednesday after the Federal reserve lowered interest rates as expected, but...

Lululemon enters sports arena with NFL apparel collaboration

VANCOUVER, Canada: Lululemon is taking its athleticwear to the gridiron. The company announced a new partnership with the National...

Primark bets on Trump’s tariff shift to win US budget shoppers

LONDON, U.K.: Primark is betting that changing U.S. trade rules will tilt the balance in its favor, accelerating store openings and...

Majority of tourism firms in Ireland see no growth, survey shows

DUBLIN, Ireland: Most tourism businesses in Ireland said their income either dropped or stayed the same this summer, according to a...

Barclays expands US footprint with $800 million Best Egg buy

LONDON, U.K.: Barclays has agreed to acquire U.S. personal loan originator Best Egg for US$800 million, marking its latest move to...

Trump, Takaichi strike mineral pact ahead of Xi meeting

TOKYO, Japan: U.S. President Donald Trump and Japanese Prime Minister Sanae Takaichi signed a landmark agreement on October 28 to secure...