Citigroup mistakenly credits $81 trillion to customer instead of $280

Robert Besser

04 Mar 2025, 11:57 GMT+10

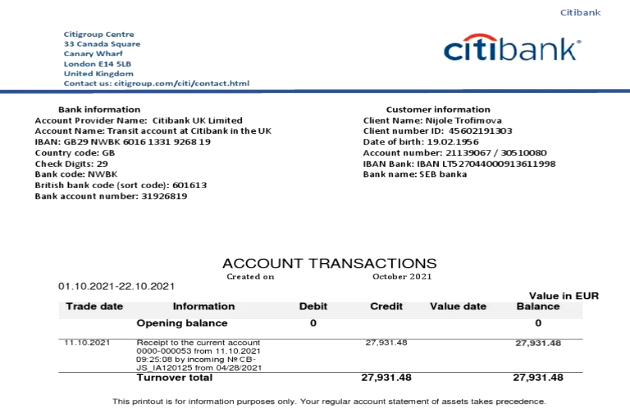

- A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly credited $81 trillion to a customer's account instead of US$280

- The error, which took hours to reverse, was caught internally before any funds left the bank, but it underscores persistent operational challenges Citigroup has been working to address

- According to the FT report, two employees responsible for reviewing the transaction initially missed the mistake before it was processed the next day

NEW YORK CITY, New York: A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly credited $81 trillion to a customer's account instead of US$280, according to a report by the Financial Times (FT) this week.

The error, which took hours to reverse, was caught internally before any funds left the bank, but it underscores persistent operational challenges Citigroup has been working to address.

According to the FT report, two employees responsible for reviewing the transaction initially missed the mistake before it was processed the next day. A third employee finally caught the issue an hour and a half later, prompting the bank to reverse the incorrect credit several hours after it had been processed.

Citigroup disclosed the incident—which qualifies as a "near miss" because no funds were lost—to U.S. regulators, including the Federal Reserve and the Office of the Comptroller of the Currency (OCC).

In response to inquiries, a Citi spokesperson told Reuters that the bank's "detective controls" quickly identified the ledger entry mistake and reversed it before it could impact the customer or the bank.

This isn't the first time Citigroup has faced scrutiny over its risk management systems. According to an internal report reviewed by the FT, Citigroup recorded 10 near misses of $1 billion or more in 2023, down slightly from 13 the previous year.

The bank has been under regulatory pressure to improve its internal controls. In 2020, Citi was fined $400 million for issues related to risk management and data governance, and in July 2023, it was fined an additional $136 million for failing to make sufficient progress in fixing those shortcomings.

Citigroup's Chief Financial Officer Mark Mason acknowledged last month that the bank is investing more in technology, data management, and compliance to strengthen its risk oversight.

"We saw the need to invest more in the transformation on data, on technology, on improving the quality of the information coming out of our regulatory reporting," Mason said.

Citigroup continues to strengthen its internal processes to reduce the frequency of such high-stakes errors. While the $81 trillion mistake was caught in time, it serves as a reminder of the risks associated with large-scale banking operations—and the importance of robust oversight mechanisms.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Africa Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Africa Leader.

More InformationInternational

SectionCivil rights groups protest Alabama bill shielding police from courts

MONTGOMERY, Alabama: A new bill in Alabama would give police officers more legal protection if they use excessive force or kill someone...

US military given 30 days to plan transgender troop removals

WASHINGTON, D.C.: The U.S. military has 30 days to decide how it will find and remove transgender service members. This may involve...

Iowa first to pass law stripping gender identity protections

DES MOINES, Iowa: Iowa lawmakers have passed a new law that removes protections for gender identity from the state's civil rights code....

Rare boost for South Korea as births rise after nearly a decade

SEOUL, South Korea: For the first time in nine years, South Korea recorded a rise in births, offering a rare positive sign in the country's...

US overdose deaths drop 24% to 87,000 in one year

WASHINGTON, D.C.: Nearly 87,000 Americans died from drug overdoses in the 12 months ending September 2024, a 24 percent drop from the...

US dockworkers approve six-year contract, securing major pay hikes

NORTH BERGEN, New Jersey: More than 45,000 U.S. dockworkers have approved a new six-year contract, securing higher wages and preventing...

Business

SectionCitigroup mistakenly credits $81 trillion to customer instead of $280

NEW YORK CITY, New York: A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly...

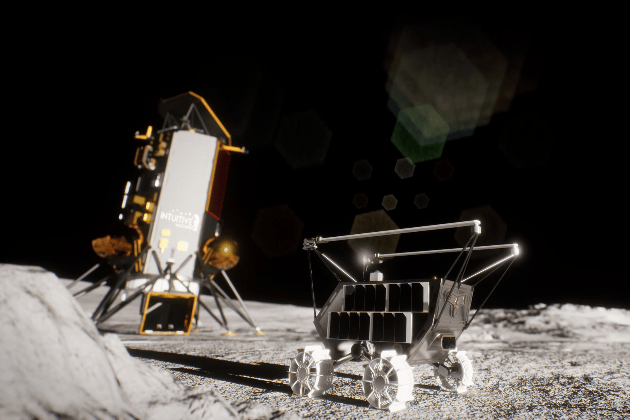

Intuitive Machines launches rocket for moon’s south pole mission

CAPE CANAVERAL, Florida: A new private lunar mission is on its way to the moon, as Intuitive Machines launched its second lander, Athena,...

Gatwick set for second runway as UK greenlights expansion

LONDON, U.K.: The UK government has tentatively approved the expansion of Gatwick Airport, paving the way for a second runway, drawing...

North Korean-backed hackers steal $1.5 billion from Dubai crypto firm

ROME, Italy: U.S. authorities have accused North Korean-backed hackers of stealing US$1.5 billion in cryptocurrency from Dubai-based...

Hong Kong promotes AI to offset 10,000 civil service job cuts

HONG KONG: Hong Kong is set to cut 10,000 civil service jobs and freeze public sector salaries as part of a cost-cutting initiative...

Alibaba releases AI model Wan 2.1 to the public

BEIJING, China: Alibaba has made its video- and image-generating AI model, Wan 2.1, publicly available, marking a significant step...