Argentina secures $20 billion IMF deal, eases currency controls

Robert Besser

17 Apr 2025, 01:11 GMT+10

- Argentina has struck a major deal with the International Monetary Fund (IMF), securing a US$20 billion loan package and rolling back strict currency controls that have shaped its economy for years

- The agreement, signed late last week, includes a 48-month Extended Fund Facility

- The IMF will disburse $12 billion by April 15, with an additional $2 billion expected by June

BUENOS AIRES, Argentina: Argentina has struck a major deal with the International Monetary Fund (IMF), securing a US$20 billion loan package and rolling back strict currency controls that have shaped its economy for years.

The agreement, signed late last week, includes a 48-month Extended Fund Facility. The IMF will disburse $12 billion by April 15, with an additional $2 billion expected by June.

"Key pillars of the program include maintaining a strong fiscal anchor, transitioning towards a more robust monetary and FX regime, with greater exchange rate flexibility," the IMF said in a statement. The deal is also expected to help Argentina regain access to international capital markets and attract further multilateral and bilateral support.

Ahead of the deal's approval, Argentina's central bank announced a major policy shift. Starting April 14, it scrapped the fixed currency peg, allowing the peso to float within a band of 1,000 to 1,400 pesos per dollar, compared to 1,074 at the April 11 close. The band will widen 1 percent each month.

The government will also dismantle significant portions of the capital controls, known locally as the "cepo," which have long restricted access to foreign currency. Businesses will now be allowed to repatriate profits.

"As of April 14, we were able to put an end to the foreign exchange restrictions which were imposed in 2019 and which limit the normal functioning of the economy," Economy Minister Luis Caputo said.

President Javier Milei, addressing the nation in a televised speech, said Argentina was "in a better position than ever to withstand external turbulences."

Still, the IMF cautioned that "downside risks remain elevated," pointing to global trade tensions and domestic political volatility in a year of legislative elections.

The new currency regime could result in a sharp devaluation if the peso drops to the lower end of the band. "This is a devaluation, which rather goes against what the government would have intended to calmly get to elections," said economist Ricardo Delgado. "It's a bit surprising that at this time of global volatility, the controls are being lifted."

The IMF deal is Argentina's 23rd with the lender. Additional support will include $12 billion from the World Bank and $10 billion from the Inter-American Development Bank.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Africa Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Africa Leader.

More InformationInternational

SectionTrump admin ends race-based admissions at military academies

WASHINGTON, D.C.: The U.S. Military Academy and the U.S. Air Force Academy will no longer use race when deciding who gets in. For many...

Hong Kong’s last major opposition party moves to dissolve

HONG KONG: Hong Kong's last major opposition party has begun the process of dissolving, a symbolic end to decades of pro-democracy...

Justice Department blocks staff from attending ABA events

WASHINGTON, D.C: The U.S. Department of Justice has told its lawyers they can no longer attend or speak at events hosted by the American...

US Defense Secretary Pete Hegseth Cancels $5.1B IT Contracts

WASHINGTON, D.C: U.S. Defense Secretary Pete Hegseth has canceled several technology service contracts worth US$5.1 billion. These...

Trump proposes legal path for undocumented farmworkers

WASHINGTON, D.C: U.S. President Donald Trump said this week that farmers might be allowed to ask the government to keep some farmworkers...

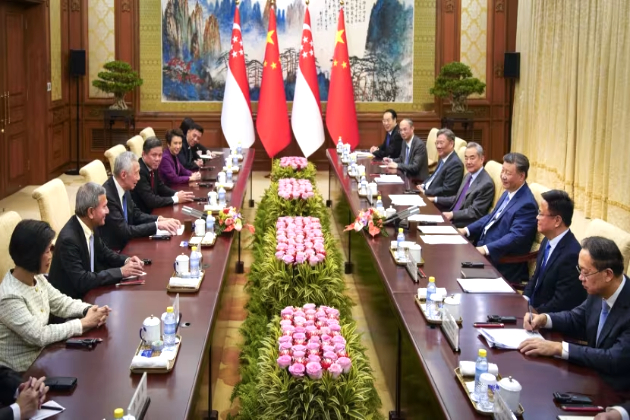

Xi Jinping shifts focus to Southeast Asia amid US tensions

BEIJING, China: As tensions with Washington deepen, Chinese President Xi Jinping is turning his focus to Southeast Asia, with a diplomatic...

Business

SectionU.S. stocks, dollar continue to be crushed by Trump tariiffs

NEW YORK, New York - Technology stocks fell sharply Wednesday, dragging down the industrial sector in its wake, as Donald Trump's trade...

Trump firm against Nippon Steel’s $15 billion U.S. Steel Deal

ABOARD AIR FORCE ONE/TOKYO: U.S. President Donald Trump reaffirmed his opposition to a foreign takeover of U.S. Steel, casting renewed...

Argentina secures $20 billion IMF deal, eases currency controls

BUENOS AIRES, Argentina: Argentina has struck a major deal with the International Monetary Fund (IMF), securing a US$20 billion loan...

Japan eyes stronger yen ahead of US trade talks

TOKYO, Japan: As Japan prepares for critical trade talks with the United States, a top policymaker has stressed the need to strengthen...

Wall Street closes Tuesday with minor losses

NEW YORK, New York - U.S. stocks ended with minor losses on Tuesday as investors and traders continued to navigate markets with continued...

GM to press pause on EV van production in Ontario

DETROIT, Michigan: General Motors is hitting pause on production of its BrightDrop electric vans in Ontario, Canda, citing the need...