Wall Street marches higher on Trump tariffs reprieve

Big News Network.com

15 Apr 2025, 01:49 GMT+10

- The Dow Jones Industrial Average gained 312.08 points, or 0.78 percent, ending at 40,524.79.

- The Nasdaq Composite advanced 107.03 points, or 0.64 percent, finishing at 16,831.48.

- The Standard and Poor's 500 rose 42.61 points, or 0.79 percent, to close at 5,405.97.

NEW YORK, New York - Automakers and tech companies helped to lift U.S, stock indices Monday as stock markets around the world saw a reprieve from trade tensions due to weekend comments and actions by the Trump administration.

"The market believes that the administration is probably in some sort of retreat from their most-extreme tariff proposal," ed Ellerbroek, portfolio manager at Argent Capital Management told CNBC Monday. "That's incremental good news."

Imported automobiles and parts could get a reprieve along with computers and smart phones. Messages however from the president himself, and his closest advisors still tended to be mixed.

"I'm looking at something to help car companies with it," the U.S. president said Sunday. "They're switching to parts that were made in Canada, Mexico, and other places, and they need a little bit of time because they're going to make them here," Mr Trump added.

Following are Monday's closing quotes for key U.S. indices:

-

The Standard and Poor's 500 rose 42.61 points, or 0.79 percent, to close at 5,405.97.

-

The Dow Jones Industrial Average gained 312.08 points, or 0.78 percent, ending at 40,524.79.

-

The Nasdaq Composite advanced 107.03 points, or 0.64 percent, finishing at 16,831.48.

Investors reacted positively to the White House's announcement that smartphones and computers would be temporarily exempted from new tariffs, alleviating concerns about potential cost increases for consumer electronics. However, the administration indicated that additional levies on semiconductors are expected to be announced later in the week.

Global Currencies Gain as U.S. Dollar Slips Amid Tariff Uncertainty

On Monday, April 14, 2025, the U.S. dollar weakened against major currencies, as investors reacted to the White House's inconsistent trade policies and growing concerns over the stability of U.S. assets. The dollar's decline was influenced by President Donald Trump's temporary exemptions on tariffs for certain tech products, which, while offering short-term relief, failed to alleviate broader market anxieties.

The euro edged up 0.04 percent to $1.1363, nearing a three-year high, bolstered by expectations of a European Central Bank rate cut later this week. The British pound surged 0.86 percent to $1.3195, its highest level in six months, as investors sought alternatives to the dollar amid ongoing trade tensions.

In the Asia-Pacific region, the New Zealand dollar led gains, climbing 1.16 percent to $0.5886, while the Australian dollar rose 0.73 percent to $0.6336. The Japanese yen appreciated 0.29 percent against the dollar, reaching 143.02, as Japan prepared for upcoming trade talks with the U.S.

The Swiss franc also strengthened, with the USD/CHF pair declining 0.08 percent to 0.8133, reflecting the franc's appeal as a safe-haven currency. Meanwhile, the Canadian dollar saw a modest gain, with the USD/CAD pair increasing 0.05 percent to 1.3869.

Analysts attribute the dollar's weakness to a combination of factors, including erratic trade policies, a sharp sell-off in U.S. treasuries, and a broader reassessment of the dollar's role as the global reserve currency. The European Central Bank's anticipated rate cut and the Bank of England's upcoming economic data releases are expected to further influence currency markets in the coming days.

As global markets navigate the uncertainties surrounding U.S. trade policies, investors continue to seek stability in other major currencies, leading to the dollar's ongoing decline.

Global Markets Surge Amid Tariff Reprieve

Global stock markets rallied on Monday, April 14, 2025, buoyed by the U.S. administration's decision to temporarily exempt smartphones, laptops, and other electronics from tariffs on Chinese imports. This move alleviated investor concerns over escalating trade tensions and sparked a broad-based rally across major indices.

Canada:

-

The S&P/TSX Composite Index climbed 278.73 points, or 1.18 percent, to settle at 23,866.53.

The Canadian market's gains were broad-based, with significant contributions from the technology and energy sectors. The rally was supported by easing trade tensions and a rebound in commodity prices.

UK and European Markets

European and UK indices posted robust gains:

-

Germany's DAX surged 580.73 points to 20,954.83, up 2.85 percent.

-

France's CAC 40 climbed 168.32 points to 7,273.12, a 2.37 percent increase.

-

The EURO STOXX 50 rose 124.16 points to 4,911.39, gaining 2.59 percent.

-

The Euronext 100 advanced 37.46 points to 1,437.33, up 2.68 percent.

-

Belgium's BEL 20 added 105.55 points to 4,134.52, a 2.62 percent rise.

-

The UK's FTSE 100 increased by 170.16 points to 8,134.34, marking a 2.14 percent gain.

Asian-Pacific Markets

Asian markets also experienced significant upticks:

-

Hong Kong's Hang Seng Index rose 502.71 points to 21,417.40, up 2.40 percent.

-

Singapore's STI Index gained 36.38 points to 3,548.91, a 1.04 percent increase.

-

Australia's S&P/ASX 200 climbed 102.10 points to 7,748.60, up 1.34 percent.

-

The All Ordinaries added 106.00 points to 7,959.70, a 1.35 percent rise.

-

India's S&P BSE SENSEX surged 1,310.16 points to 75,157.26, gaining 1.77 percent.

-

Malaysia's FTSE Bursa Malaysia KLCI increased by 26.10 points to 1,480.86, up 1.79 percent.

-

New Zealand's S&P/NZX 50 Index Gross rose 88.41 points to 12,107.54, a 0.74 percent gain.

-

South Korea's KOSPI Composite Index added 23.17 points to 2,455.89, up 0.95 percent.

-

Japan's Nikkei 225 advanced 396.78 points to 33,982.36, a 1.18 percent increase.

-

Taiwan's TWSE Capitalization Weighted Stock Index was the outlier, declining by 15.68 points to 19,513.09, a 0.08 percent drop.

Middle East & Africa

Markets in the Middle East and Africa showed positive movements:

-

Israel's TA-125 rose 56.31 points to 2,511.43, up 2.29 percent.

-

Egypt's EGX 30 Price Return Index edged up 7.80 points to 31,182.40, a 0.03 percent increase.

-

South Africa's Top 40 USD Net TRI Index surged 199.60 points to 4,656.31, gaining 4.48 percent.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Africa Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Africa Leader.

More InformationInternational

SectionUS Defense Secretary Pete Hegseth Cancels $5.1B IT Contracts

WASHINGTON, D.C: U.S. Defense Secretary Pete Hegseth has canceled several technology service contracts worth US$5.1 billion. These...

Trump proposes legal path for undocumented farmworkers

WASHINGTON, D.C: U.S. President Donald Trump said this week that farmers might be allowed to ask the government to keep some farmworkers...

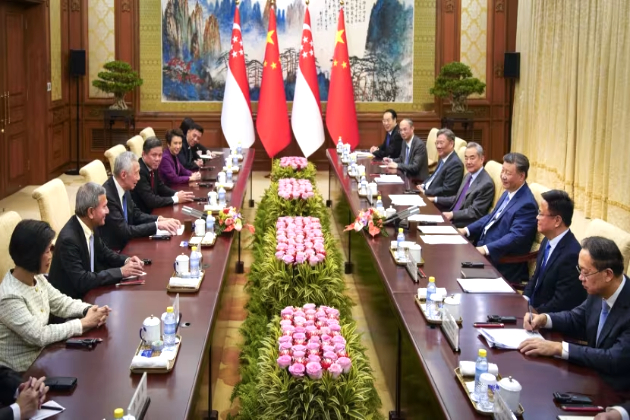

Xi Jinping shifts focus to Southeast Asia amid US tensions

BEIJING, China: As tensions with Washington deepen, Chinese President Xi Jinping is turning his focus to Southeast Asia, with a diplomatic...

LA County offers free lead tests near wildfire burn zones

PASADENA, California: Because many people are worried about dangerous chemicals in smoke, ash, and debris from recent wildfires, Los...

Trump lifts shower pressure limits to protect 'beautiful hair'

WASHINGTON, D.C.: President Donald Trump, who had often complained about weak water pressure in showers, has signed an order to remove...

Apple airlifts iPhones from India to dodge new US tariffs

NEW DELHI, India: Apple has ramped up shipments of iPhones from India to the United States, chartering aircraft to move hundreds of...

Business

SectionGM to press pause on EV van production in Ontario

DETROIT, Michigan: General Motors is hitting pause on production of its BrightDrop electric vans in Ontario, Canda, citing the need...

China, EU talks could pave the way for price resolution

BERLIN, Germany: Talks between the EU and China could pave the way for a shift from tariffs to minimum price agreements on Chinese...

Tesla stops China Orders for US-made models amid trade tensions

BEIJING, China: Tesla has halted new orders in China for its two U.S.-made premium models as trade tensions between Washington and...

Wall Street marches higher on Trump tariffs reprieve

NEW YORK, New York - Automakers and tech companies helped to lift U.S, stock indices Monday as stock markets around the world saw a...

India seeks to fast-track US trade deal after tariff pause

NEW DELHI, India: India is pushing to fast-track a trade agreement with the United States following a temporary pause on new tariffs,...

Vietnam to crack down on rerouted Chinese goods to avoid US tariffs

HANOI, Vietnam: Vietnam is preparing a series of trade enforcement measures as it scrambles to shield itself from sweeping U.S. tariffs,...