Wall Street ends volatile day higher

Lola Evans

30 May 2025, 01:46 GMT+10

- Dow Jones Industrial Average climbed 117.03 points, or 0.28 percent, to 42,215.73, marking its third straight day of gains.

- Nasdaq Composite advanced 74.93 points, or 0.39 percent, to settle at 19,175.87, supported by strong performances in mega-cap tech stocks.

- Standard and Poor's 500 rose 23.62 points, or 0.40 percent, to close at 5,912.17, led by gains in technology and financial sectors.

NEW YORK, New York - U.S. stock markets see-sawed Thursday as the judicial system became a key player in Donald Trump's trade wars. A court initially halted the Trump tariffs, and then a day later an appeals court overturned the decision.

"In general, markets don't like uncertainty, because it makes forecasting more difficult," Larry Tentarelli, founder of the Blue Chip Daily Trend Report, told CNBC Thursday. "We expect the tariff news cycle to be an extended process, which can lead to higher short-term volatility."

Despite the earlier turmoil and confusion, U.S. stocks closed broadly higher on Thursday,.

U.S. Markets Rally

-

Standard and Poor's 500 rose 23.62 points, or 0.40 percent, to close at 5,912.17, led by gains in technology and financial sectors.

-

Dow Jones Industrial Average climbed 117.03 points, or 0.28 percent, to 42,215.73, marking its third straight day of gains.

-

Nasdaq Composite advanced 74.93 points, or 0.39 percent, to settle at 19,175.87, supported by strong performances in mega-cap tech stocks. Nvidia (NVDA) shares rose $4.38 or 3.25 percent to close at $139.19. Conversely, Trump Media (DJT) fell 0.66c or 3.07 percent to $20.83.

Trading volumes were robust, with the S&P 500 seeing 2.826 billion shares traded, while the Nasdaq recorded 10.031 billion shares changing hands.

Market Drivers

The rally in U.S. equities was fueled by:

-

Optimism over interest rate cuts following softer labor market data, which bolstered hopes for a Federal Reserve policy shift.

-

Strength in tech stocks, with AI-related names continuing to lead gains.

-

Resilient economic data, easing fears of an imminent slowdown.

Looking Ahead

Investors will turn their attention to Friday's U.S. nonfarm payrolls report for further clues on the Fed's rate path. A weaker-than-expected jobs number could reinforce expectations for rate cuts, while a strong reading may temper recent optimism.

Dollar Slips Across the Board as Euro, Yen, Pound, Commodity Currencies all Gain

The U.S. dollar weakened against all major currencies in Thursday's trading session, with the euro posting the strongest gains amid shifting central bank expectations.

Key Moves

-

EUR/USD jumped 0.68 percent to 1.1367, its highest level in three weeks, as markets priced in delayed Fed rate cuts.

-

USD/JPY fell 0.49 percent to 144.11, with the yen recovering despite Japan's ultra-loose monetary policy.

-

GBP/USD edged up 0.21 percent to 1.3492, while commodity-linked AUD/USD and NZD/USD rose 0.33 percent and 0.18 percent, respectively.

-

Safe-haven USD/CHF dropped 0.38 percent to 0.8228, and USD/CAD declined 0.22 percent to 1.3805 as oil prices stabilized.

Why It Matters

The broad dollar retreat reflects:

-

Fed dovishness: Markets now see a 65 percent chance of a September rate cut (vs. 50 percent last week).

-

Eurozone resilience: Stronger EU PMI data reduced ECB urgency for additional easing.

-

Risk appetite: Commodity currencies found support despite China growth concerns.

Next Watch

Friday's U.S. nonfarm payrolls report could either extend the dollar's slide or trigger a rebound if jobs data surprises.

Global Markets Thursday: Asia Outperforms, Europe Struggles - Japan, Mideast and Africa shine

Global stock markets ended the trading session with mixed results on Thursday, as Asian indices posted strong gains, while European benchmarks faced declines. Best performers were bourses in Hong Kong and South Africa.

Canada Bucks the Trend

In contrast to its southern neighbour, Canada's S&P/TSX Composite index dipped 72.89 points, or 0.28 percent, to 26,210.56, weighed down by declines in energy and materials stocks amid softer commodity prices. Trading volume totaled 215.842 million shares.

UK and Europe See Broad Declines

The FTSE 100 (UK) dipped slightly, closing at 8,716.45, down 9.56 points or 0.11 percent. Meanwhile, Germany's DAX fell sharply to 23,933.23, losing 104.96 points or 0.44 percent. In France the CAC 40 edged lower to 7,779.72, shedding 8.38 points or 0.11 percent.

The broader EURO STOXX 50 dropped 44.35 points or 0.82 percent Thursday to 5,371.10, while the Euronext 100 Index saw a marginal decline of 0.49 points or 0.03 percent, settling at 1,585.17. Belgium's BEL 20 was a rare bright spot, rising 9.75 points or 0.22 percent to 4,497.47.

Asian Markets Rally

In contrast, Asian indices posted strong gains. Hong Kong's Hang Seng Index surged 315.07 points or 1.35 percent to 23,573.38, while South Korea's KOSPI jumped 50.49 points or 1.89 percent to 2,720.64.

In Japan the Nikkei 225 soared 710.58 points or 1.88 percent Thursday to 38,432.98, buoyed by positive economic data.

Australia's S&P/ASX 200 and All Ordinaries both rose 12.90 points or 0.15 percent, closing at 8,409.80 and 8,637.80, respectively.

China Rises Modestly

China's SSE Composite Index added 23.51 points or 0.70 percent, closing at 3,363.45.

Mixed Performance in Other Regions

-

India's S&P BSE SENSEX climbed 320.70 points or 0.39 percent to 81,633.02.

-

Singapore's STI Index edged up 4.92 points or 0.13 percent to 3,916.84.

-

Taiwan's TWSE Index dipped slightly, losing 10.42 points or 0.05 percent to 21,347.30.

-

Indonesia's IDX Composite fell 23.15 points or 0.32 percent Thursday to 7,175.82.

-

Malaysia's KLCI declined 4.50 points or 0.30 percent to 1,518.98.

-

New Zealand's NZX 50 dropped 80.95 points or 0.65 percent to 12,281.31.

Middle East and Africa Show Gains

-

Israel's TA-125 rose 14.31 points or 0.53 percent to 2,724.72.

-

Egypt's EGX 30 surged 202.90 points or 0.62 percent Thursday to 32,696.80.

-

South Africa's Top 40 USD Index gained 87.65 points or 1.70 percent to 5,256.47.

Related stories:

Wednesday 28 May 2025 | U.S. stocks slide as 30-year bond yiwlds top 5 percent | Big News Network

Tuesday 27 May 2025 | Dow Jones soars 741 points on robust consumer confidence | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Africa Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Africa Leader.

More InformationInternational

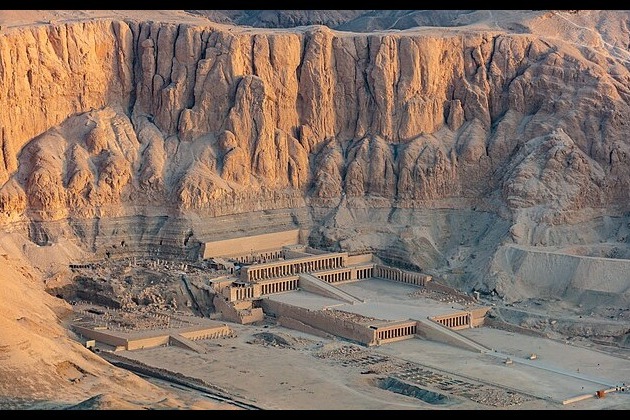

SectionEgypt unveils ancient tombs of New Kingdom officials in Luxor

CAIRO, Egypt: Egypt has revealed three newly discovered tombs in the Dra Abu al-Naga necropolis in Luxor. These tombs, found by Egyptian...

Global central bankers in Tokyo address discuss inflation and slowdown

TOKYO, Japan: As global inflation remains stubborn and growth prospects dim, central bankers from around the world gathered in Tokyo...

Quits job, sails ocean: Oliver Widger reaches Hawaii with cat Phoenix

HONOLULU, Hawaii: A man from Oregon, Oliver Widger, has arrived in Hawaii after sailing across the ocean with his cat, Phoenix. He...

Argentinian church leader raps Milei at national religious ceremony

BUENOS AIRES, Argentina: The Archbishop of Buenos Aires, Jorge García Cuerva, used a major religious event over the weekend to criticize...

Historic vote for judges in Mexico marred by criminal ties

CIUDAD JUAREZ, Mexico: In a first-of-its-kind judicial election in Mexico, more than 5,000 candidates are vying for over 840 federal...

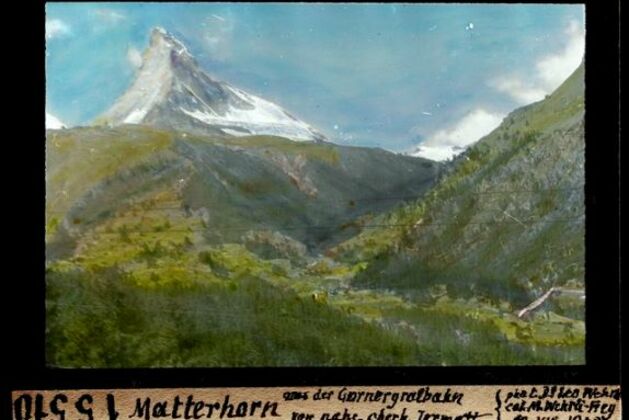

Bodies of 5 missing skiers recovered on mountain in Switzerland

ZERMATT, Switzerland: Five skiers were found dead on a mountain in Switzerland near the popular ski resort of Zermatt, officials said...

Business

SectionAmid losses, Nissan bets on e-Power hybrid to revive US sales

YOKOSUKA, Japan: Facing mounting losses and global restructuring, Japan's Nissan Motor Corp. is turning to its unique e-Power hybrid...

Wall Street ends volatile day higher

NEW YORK, New York - U.S. stock markets see-sawed Thursday as the judicial system became a key player in Donald Trump's trade wars....

French farmers jam Paris roads in push for eased regulations

PARIS, France: French farmers brought traffic to a crawl around Paris and gathered outside the National Assembly on May 26, using their...

Amid trade tensions, France, Vietnam ink deals worth $10 billion

HANOI, Vietnam: Amid shifting global trade dynamics and growing concerns over U.S. tariffs, France and Vietnam have signed more than...

Wall Street has relapse Wednesday, after Tuesday's heady gains

NEW YORK, New York - U.S. stocks were weaker Wednesday, following Tuesday's heady gains when the Dow Jones jumped 741 points. Bond...

China’s GAC launches in Brazil as EV demand accelerates

SAO PAULO, Brazil: Amid a surge in electric vehicle (EV) adoption and growing competition in Brazil, Chinese automaker GAC has officially...