US consumer financial watchdog staff get paid, with little work to do

Mohan Sinha

18 Jul 2025, 15:09 GMT+10

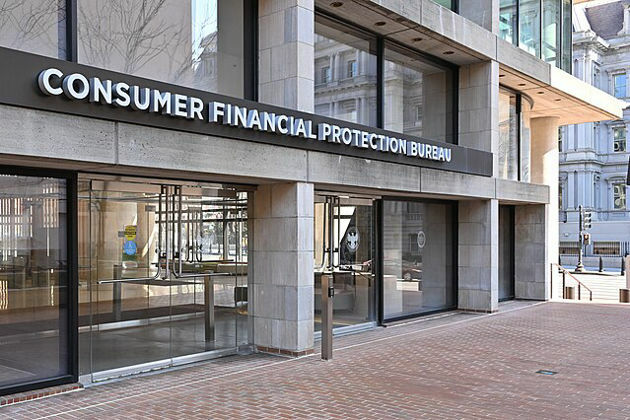

- For the last six months, the Consumer Financial Protection Bureau has been issuing pay cheques to its staff who have been ordered not to perform their duties, leaving the bureau idle in all but name

- The CFPB, established 15 years ago to police banks and financial service providers, has been instrumental in returning some US$21 billion to consumers harmed by predatory practices

- Now, the agency’s core mission is being dismantled under new leadership, with staff stuck in limbo—paid but prohibited from acting

NEW YORK CITY, New York: For the last six months, the Consumer Financial Protection Bureau (CFPB) has been issuing pay cheques to its staff who have been ordered not to perform their duties, leaving the bureau idle in all but name.

The CFPB, established 15 years ago to police banks and financial service providers, has been instrumental in returning some US$21 billion to consumers harmed by predatory practices. Now, the agency's core mission is being dismantled under new leadership, with staff stuck in limbo—paid but prohibited from acting.

"It feels like we're just waiting," said one current employee, who spoke anonymously due to restrictions on speaking publicly. "We show up, check emails, and try not to talk too much. Even small conversations feel risky."

Ten current and former employees, along with industry professionals who once worked closely with the bureau, painted a similar picture: internal communication has all but stopped, and staff feel adrift. The press office no longer responds to inquiries.

While the CFPB dialed back its enforcement under President Donald Trump's first term, it still pursued some consumer protection cases. That shifted under President Joe Biden, when the bureau cracked down on excessive bank fees and probed the growing role of Big Tech in financial services, securing penalties from companies like Apple.

However, the recent return of Trump's influence has reversed course dramatically. The Department of Government Efficiency—now overseen by Elon Musk—called for the CFPB's shutdown, and acting chief Russell Vought ordered employees not to carry out any job-related tasks. The courts temporarily blocked an effort to lay off 1,500 employees, but insiders worry that further cuts are imminent.

Some enforcement actions have already been rolled back. Navy Federal Credit Union, for instance, was allowed to withdraw from an $80 million settlement over unlawful overdraft fees. Toyota also avoided penalties related to questionable loan practices.

The bureau's productivity has plummeted. According to a report by Senator Elizabeth Warren, the CFPB now processes just 2,200 consumer complaints per day, down from around 10,500 before the policy shift.

There have been rare exceptions. The bureau recently settled a case with FirstCash, a national pawn chain, over illegal high-interest loans to service members, resulting in a $9 million fine. However, with looming budget cuts that could slash funding in half, such enforcement actions may become even rarer.

Inside the bureau, morale has cratered. As one employee put it, each week brings "mini-funerals" as colleagues resign rather than endure the uncertainty. For those who remain, the days are quiet, the work is scarce, and the future is uncertain.

"I don't think I'll ever work in public service again," said one current employee, who has been looking for a new job for the past three months.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Africa Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Africa Leader.

More InformationInternational

SectionNew Trump plan: Allies donate weapons to Kyiv, buy weapons from US

WASHINGTON, D.C.: President Donald Trump has unveiled a new strategy to aid Ukraine without directly draining U.S. stockpiles: encourage...

Horse-drawn carriage debate reignites with trial of NYC driver

NEW YORK CITY, New York: A New York City carriage driver went on trial this week in a case that has reignited long-standing tensions...

Russia scoffs at Trump’s sanctions ultimatum over Ukraine

MOSCOW, Russia: Brushing aside U.S. President Donald Trump's latest threat to impose steep sanctions on buyers of Russian exports unless...

Court: UK moved Afghans after 33,000 names leaked online

LONDON, U.K.: The British government secretly launched a large-scale relocation scheme for Afghans after a soldier accidentally leaked...

Grand Canyon Lodge, 70 other structures lost in North Rim fire

GRAND CANYON NATIONAL PARK, Arizona: A wildfire that destroyed the historic Grand Canyon Lodge and over 70 other structures on the...

India, Poland, Hungary complete first ISS mission with NASA vet

LOS ANGELES, United States: A multinational crew of astronauts, including the first space travelers from India, Poland, and Hungary...

Business

SectionJury in Miami to decide if Tesla is liable in autopilot-linked death

NEW YORK CITY, New York: A high-stakes trial involving Tesla began this week in Miami, where a jury will determine whether the company...

Taiwan's semiconductor sector targeted in rising cyberattacks

SUNNYVALE, California: Cyber espionage groups aligned with China have ramped up targeted attacks on Taiwan's semiconductor sector and...

U.S. stocks end week on mixed note, Nasdaq Composite edges up

NEW YORK, New York - Wall Street ended Friday with a mixed performance as investors digested a week of robust economic data, with the...

Apple strikes rare earth supply deal amid China trade pressure

CUPERTINO, California: Apple has signed a US$500 million supply agreement with MP Materials for rare earth magnets, a strategic move...

US consumer financial watchdog staff get paid, with little work to do

NEW YORK CITY, New York: For the last six months, the Consumer Financial Protection Bureau (CFPB) has been issuing pay cheques to its...

US ice cream firms to phase out food dyes under new plan

WASHINGTON, D.C.: A large majority of U.S. ice cream manufacturers plan to eliminate artificial food dyes from their products by 2028,...