U,.S. stock markets surge on Fed rate cut hopes

Big News Network.com

13 Aug 2025, 01:40 GMT+10

- The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in July.

- Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.

- Japan’s Nikkei 225 was the standout performer on global markets, soaring 897.69 points, or 2.15 percent,.

NEW YORK, New York - U.S, stocks closed sharply higher Tuesday after the release of the latest CPI reading which shows inflation coming under control. The tame figure for July gave invetsors and traders the confidence they need to expect a Fed rate cut in September.

"The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in July, after rising 0.3 percent in June," the U.S. Bureau of Labor Statistics reported Wednesday. "Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment."

U.S. Markets Surge Ahead

The S&P 500 (^GSPC) jumped 72.31 points, or 1.13 percent, to close Tuesday at 6,445.76, marking its strongest session in weeks. Trading volume reached 2.834 billion shares as buyers piled into large-cap stocks.

The Dow Jones Industrial Average (^DJI) also posted strong gains, climbing 483.52 points, or 1.10 percent, to settle at 44,458.61, with 436.933 million shares traded. The blue-chip index was lifted by strong performances in financial and industrial sectors.

Tech stocks led the charge, with the Nasdaq Composite (^IXIC) surging 296.50 points, or 1.39 percent, to 21,681.90, its highest close ever. Trading activity was robust at 6.78 billion shares as megacap tech names powered the index higher.

Market Drivers

Analysts attributed Tuesday's bullish momentum to:

-

Growing expectations of Federal Reserve rate cuts later this year

-

Strong earnings reports from major retailers

-

Cooling bond yields that eased pressure on growth stocks

"Investors are clearly betting that the soft landing scenario remains intact," sMark Richardson, chief strategist at Wellington Capital. said Tuesday "The breadth of today's rally suggests confidence is returning to multiple sectors, not just tech."

Global Forex Markets Show Mixed Movements in Tuesday's Trading Session

The foreign exchange market saw a split performance on Tuesday, with the U.S. dollar weakening against most currencies on the back of the tame CPI report.

Key Currency Pairs in Focus

The Euro (EUR/USD) strengthened against the U.S. dollar, rising 0.50 percent to 1.1673, as investors weighed expectations of European Central Bank policy moves. Meanwhile, the U.S. dollar (USD/JPY) dipped slightly against the Japanese yen, falling 0.27 percent to 147.73, as traders assessed potential Bank of Japan intervention risks.

In North America, the Canadian dollar (USD/CAD) held steady, with the pair inching down just 0.01 percent to 1.3776, reflecting muted reaction to oil price fluctuations.

The British pound (GBP/USD) extended its gains, climbing 0.47 percent to 1.3494, supported by stronger-than-expected UK economic data.

Swiss Franc and Commodity Currencies Move Higher

The U.S. dollar (USD/CHF) faced notable pressure against the Swiss franc, sliding 0.72 percent to 0.8064, as demand for the safe-haven currency picked up.

Commodity-linked currencies also advanced, with the Australian dollar (AUD/USD) rising 0.26 percent to 0.6529 and the New Zealand dollar (NZD/USD) gaining 0.29 percent to 0.5953, supported by improved risk appetite in Asian trading, and despite a 25 basis points reduction in official interest rates by the Reserve Bank of Australia..

Global Markets End Mixed Tuesday | Japan's Nikkei 225 surges again, gaines 898 points

Global stock indices delivered a mixed performance on Tuesday, with some markets posting gains while others retreated amid fluctuating investor sentiment.

In Canada, the S&P/TSX Composite (^GSPTSE) advanced 146.03 points, or 0.53 percent, to finish at 27,921.26, supported by gains in energy and materials stocks. Volume reached 203.659 million shares.

In London the FTSE 100 (^FTSE) edged higher, closing at 9,147.81, up 18.10 points, or 0.20 percent.

Meanwhile, Germany's DAX (^GDAXI) dipped 56.56 points, or 0.23 percent, to settle at 24,024.78.

In France the CAC 40 (^FCHI) outperformed, rising 54.90 points, or 0.71 percent, to 7,753.42. The broader EURO STOXX 50 (^STOXX50E) inched up 4.12 points, or 0.08 percent, to 5,335.97.

The Euronext 100 (^N100) climbed 8.87 points, or 0.56 percent, to 1,587.17, while Belgium's BEL 20 (^BFX) slipped slightly, losing 2.12 points, or 0.04 percent, to close at 4,724.63.

Asia and Pacific Markets Show Divergence

In Asia, Hong Kong's Hang Seng Index (^HSI) gained 62.87 points, or 0.25 percent, finishing at 24,969.68. However, Singapore's STI Index (^STI) fell 12.06 points, or 0.28 percent, to 4,220.72.

In China, the Shanghai Composite (000001.SS) climbed 18.37 points, or 0.50 percent, to 3,665.92, with a turnover of 2.123 billion. Japan's Nikkei 225 (^N225) was the standout performer, soaring 897.69 points, or 2.15 percent, to 42,718.17.

Australia's S&P/ASX 200 (^AXJO) advanced 36.00 points, or 0.41 percent, to 8,880.80, while the All Ordinaries (^AORD) rose 32.70 points, or 0.36 percent, to 9,150.30.

India's S&P BSE SENSEX (^BSESN) dropped 368.48 points, or 0.46 percent, to 80,235.59, while Indonesia's IDX Composite (^JKSE) surged 185.77 points, or 2.44 percent, to 7,791.70. Malaysia's KLSE (^KLSE) added 4.66 points, or 0.30 percent, closing at 1,567.90.

New Zealand's S&P/NZX 50 (^NZ50) was among the day's biggest decliners, shedding 152.18 points, or 1.18 percent, to 12,759.68. South Korea's KOSPI (^KS11) also retreated, losing 16.86 points, or 0.53 percent, to 3,189.91.

Taiwan's TWSE (^TWII) rose 22.86 points, or 0.09 percent, to 24,158.36, while Israel's TA-125 (^TA125.TA) tumbled 52.65 points, or 1.76 percent, to 2,941.06.

Other Key Markets

Egypt's EGX 30 (^CASE30) gained 95.20 points, or 0.27 percent, to 36,003.70, with a trading volume of 165.869 million. South Africa's Top 40 (^JN0U.JO) jumped 80.52 points, or 1.43 percent, to 5,722.21.

Related story:

Monday 11 August 2025 | U.S. stock markets weaken Monday ahead of CPI data | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Africa Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Africa Leader.

More InformationInternational

SectionUN official’s trip aims to ease strained relations, says Tehran

TEHRAN, Iran: The deputy head of the United Nations' nuclear watchdog arrived in Iran on August 11 in an effort to mend deteriorating...

Albanese joins France, U.K. Canada in recognizing Palestinian state

CANBERRA, Australia: Prime Minister Anthony Albanese announced on August 11 that Australia will formally recognize a Palestinian state,...

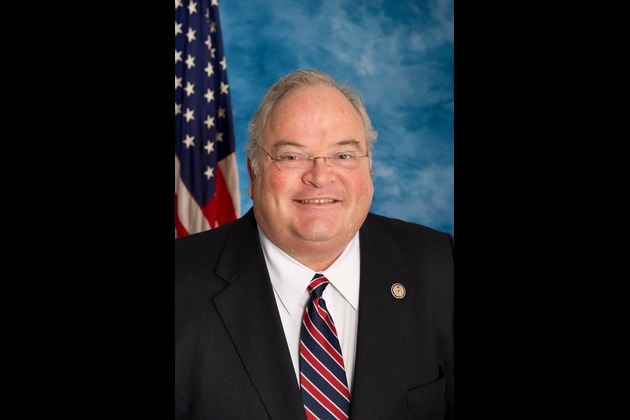

Billy Long out as IRS commissioner after less than two months

WASHINGTON, D.C.: President Donald Trump has removed former U.S. Rep. Billy Long from his post as IRS commissioner less than two months...

Florida administration awards contract for 'north detention facility'

TALLAHASSEE, Florida: Florida Governor Ron DeSantis' administration appears to be moving forward with plans to build a second immigration...

US doubles bounty on Maduro for major narco-trafficking role

MIAMI, Florida: The Trump administration has doubled its bounty for the arrest of Venezuelan President Nicolás Maduro to US$50 million,...

On 80th anniversary, Nagasaki prays for no more nuclear attacks

NAGASAKI, Japan: Eighty years after the U.S. atomic bombing of Nagasaki, the southern Japanese city paused on August 9 to remember...

Business

SectionU,.S. stock markets surge on Fed rate cut hopes

NEW YORK, New York - U.S, stocks closed sharply higher Tuesday after the release of the latest CPI reading which shows inflation coming...

Rice and small payouts offered for land in Trump golf resort deal

HUNG YEN, Vietnam: In Hung Yen province near Hanoi, farmers say they are being offered meager compensation, sometimes just a few thousand...

Postal Service blocks illicit vape shipments, rattling industry

LONDON, U.K.: The U.S. Postal Service has begun blocking business shipments of unregulated vaping products from at least one major...

US to take 15% revenue cut from Nvidia, AMD China chip shipments

WASHINGTON, D.C.: Nvidia and AMD have agreed to give the U.S. government 15 percent of revenue from sales to China of certain advanced...

US stocks decline on opening day of week, Dow drops 200 points

NEW YORK, New York - U.S. stocks ended weaker on Monday in volatile trading, as investors and traders look to economic data due this...

AI shift could cost 500,000 jobs in India’s outsourcing industry

BENGALURU, India: Tata Consultancy Services' decision to lay off more than 12,000 employees is being seen by industry experts as an...