U.S. stocks close higher Tuesday, shrugging off Trump's Fed play

Lola Evans

27 Aug 2025, 01:53 GMT+10

- The Dow Jones Industrial Average added 135.60 points, gaining 0.30 percent to close at 45,418.07.

- The NASDAQ Composite, heavily weighted toward tech stocks, climbed 94.98 points, or 0.44 percent, to end the day at 21,544.27.

- The Standard and Poor's 500 rose 26.62 points, or 0.41 percent, to finish at 6,465.94.

NEW YORK, New York - U.S. stocks advanced Tuesday despite another attempt by President Donald Trump to undermine the Federal Reserve in a bid to drive down interest rates. Trump personally, according to a report last week by CNBC, has been heavily buying up U.S. bonds, which will spike sharply higher if interest rates are lowered significantly. Trump on Tuesday attempted to fire Federal Reserve board member Lisa Cook, however Cook resisted the move and has launched legal action.,

"President Trump has no authority to remove Federal Reserve Governor Lisa Cook," lawyer Abbe Lowell said in a statement Tuesday. "His attempt to fire her, based solely on a referral letter, lacks any factual or legal basis."

U.S. stocks Tuesday were buoyed by gains in technology, industrials, and energy sectors. Aside from the furore over Cook's firing, investors also shrugged off concerns about inflation and interest rates, pushing major indexes further into positive territory.

The Standard and Poor's 500 rose 26.62 points, or 0.41 percent, to finish at 6,465.94, marking another strong session as large-cap tech and consumer discretionary names led the charge.

The Dow Jones Industrial Average added 135.60 points, gaining 0.30 percent to close at 45,418.07, supported by a solid performance from blue-chip industrials and financials.

The NASDAQ Composite, heavily weighted toward tech stocks, climbed 94.98 points, or 0.44 percent, to end the day at 21,544.27, as enthusiasm for AI-linked firms and semiconductor companies continued to fuel momentum.

Market Insight

Trading volume remained solid, with more than 3.2 billion shares exchanged on the S&P 500 and over 8.2 billion shares on the NASDAQ. Market sentiment appeared cautiously optimistic as investors await upcoming inflation data and further guidance from central banks later in the week.

With broad-based gains across major benchmarks, analysts are watching for signs of market consolidation or continued upward momentum as the final stretch of the quarter approaches.

U.S. Dollar Dumped After Trump Fires Federal Reserve Board Member Lisa Cook

The U.S. dollar ended broadly lower against a basket of major currencies on Monday, after President Trump sacked Lisa Cook. The greenback's losses were trimmed when Cook said she would not accept being fired and launched legal action against the Trump administration. The president's actions including wanting to fire Chair Jay Powell, are seen as undermiinng the independence of the central bank.

The euro edged higher against the greenback, with the EUR/USD pair climbing 0.23 percent to close at 1.1644.

The British pound also advanced, with GBP/USD rising 0.22 percent to 1.3481, as traders looked past sluggish economic data and focused on stabilizing inflation trends in the UK.

In the Pacific currencies, the Australian dollar and New Zealand dollar both strengthened modestly. The AUD/USD rose 0.19 percent to 0.6493, while the NZD/USD gained 0.24 percent, settling at 0.5861. The gains reflect improving risk appetite and signs of resilience in Asia-Pacific economies.

The Japanese yen made gains against the dollar, as USD/JPY declined 0.27 percent to 147.36. The move followed soft U.S. Treasury yields and investor demand for safe-haven assets amid market uncertainty.

In North America, the Canadian dollar also gained ground, with the USD/CAD pair falling 0.19 percent to 1.3833, supported by firm commodity prices and a steadier economic outlook.

Meanwhile, the Swiss franc strengthened notably, pushing the USD/CHF pair down 0.35 percent to 0.8031, as the franc benefited from safe-haven flows and continued monetary tightening from the Swiss National Bank.

Global Stock Markets Close Lower on Tuesday as Caution Prevails

Major global stock markets broadly declined on Tuesday amid renewed concerns over economic headwinds, central bank policy direction, and weaker investor sentiment. Here's a region-by-region breakdown of how key indices performed:

Canada

In Canada, the S&P/TSX Composite Index rose 169.94 points, or 0.60 percent, to settle at 28,339.88, driven by strength in energy, materials, and financials.

Europe

European indices fell across the board, reflecting unease over stagnant growth and inflation dynamics across the continent.

-

FTSE 100 (UK): 9,265.80, down 55.60 points (–0.60 percent)

-

DAX Performance Index (Germany): 24,152.87, down 120.25 points (–0.50 percent)

-

CAC 40 (France): 7,709.81, down 133.23 points (–1.70 percent)

-

EURO STOXX 50: 5,383.68, down 60.28 points (–1.11 percent)

-

Euronext 100 (Pan-European): 1,597.98, down 20.80 points (–1.28 percent)

-

BEL 20 (Belgium): 4,836.18, down 25.02 points (–0.51 percent)

Asia and Pacific

Asia-Pacific markets mirrored the global retreat, with most indices in the red, except for Taiwan, which eked out a gain.

-

Nikkei 225 (Japan): 42,394.40, down 413.42 points (–0.97 percent)

-

TWSE (Taiwan): 24,305.10, up 27.72 points (+0.11 percent)

-

Hang Seng Index (Hong Kong): 25,524.92, down 304.99 points (–1.18 percent)

-

KOSPI Composite Index (South Korea): 3,179.36, down 30.50 points (–0.95 percent)

-

S&P/ASX 200 (Australia): 8,935.60, down 36.80 points (–0.41 percent)

-

All Ordinaries (Australia): 9,207.30, down 37.70 points (–0.41 percent)

-

S&P BSE Sensex (India): 80,786.54, down 849.37 points (–1.04 percent)

-

IDX Composite (Indonesia): 7,905.76, down 21.15 points (–0.27 percent)

-

FTSE Bursa Malaysia KLCI: 1,581.59, down 20.86 points (–1.30 percent)

-

S&P/NZX 50 (New Zealand): 12,957.98, down 121.52 points (–0.93 percent)

-

STI Index (Singapore): 4,243.71, down 12.78 points (–0.30 percent)

-

Shanghai Composite (China): 3,868.38, down 15.18 points (–0.39 percent)

Middle East & Africa

Mixed results were seen, with Israel showing resilience, while Egypt and South Africa declined.

-

TA‑125 (Israel): 3,128.57, up 13.24 points (+0.42 percent)

-

EGX 30 (Egypt): 35,358.30, down 452.30 points (–1.26 percent)

-

JSE Top 40 (South Africa): 5,767.93, down 63.10 points (–1.08 percent)

Related story:

Monday 25 August 2025 | Dow Jones drops 349 points Monday as stock markets cool | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Africa Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Africa Leader.

More InformationInternational

SectionGermany says Israeli attack on journalists, 'a consequence', 'unavoidable'

BERLIN, Germany - German Chancellor Friedrich Merz says he doesn't believe Israel targeted journalists in the attack on Gaza's Nasser...

Mass visa review targets immigration violations in US

WASHINGTON, D.C.: The Trump administration announced this week that it is conducting a sweeping review of more than 55 million people...

Defamation charges against Thailand’s Ex-PM Thaksin dismissed

BANGKOK, Thailand: Former Thai Prime Minister Thaksin Shinawatra was acquitted on August 22 in a royal defamation case that could have...

Outrage from global press groups as 6 more journalists are killed in Gaza

GAZA - In two separate attacks, the Israeli army has killed six more journalists. In the first attack, 5 journalists, including one...

Israel warns Gaza City could be razed without Hamas surrender

JERUSALEM, Israel: Israel's defense minister warned on August 22 that Gaza City faces destruction unless Hamas accepts Israel's conditions,...

Supreme Court revises ruling on stray dogs, scraps shelter relocation

NEW DELHI, India: India's Supreme Court has amended an earlier order on stray dogs, ruling that animals picked up in Delhi and surrounding...

Business

SectionU.S. stocks close higher Tuesday, shrugging off Trump's Fed play

NEW YORK, New York - U.S. stocks advanced Tuesday despite another attempt by President Donald Trump to undermine the Federal Reserve...

Trump Media Teams With Crypto.com to Launch Blockchain Rewards

SARASOTA, Florida, - Trump Media and Technology Group Corp, operator of the social media platform Truth Social, the streaming platform...

Trump unveils $8.9 billion Intel rescue, US to own 9.9% equity stake

WASHINGTON, D.C.: The U.S. government will take a nearly 10 percent equity stake in Intel, converting billions of dollars in federal...

Damascus to revalue pound, new notes planned after Assad’s ouster

DAMASCUS, Syria: Syria is preparing a sweeping overhaul of its battered currency, with plans to issue new banknotes that drop two zeros...

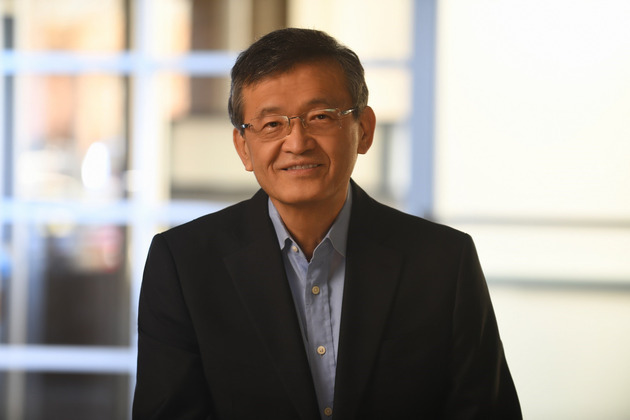

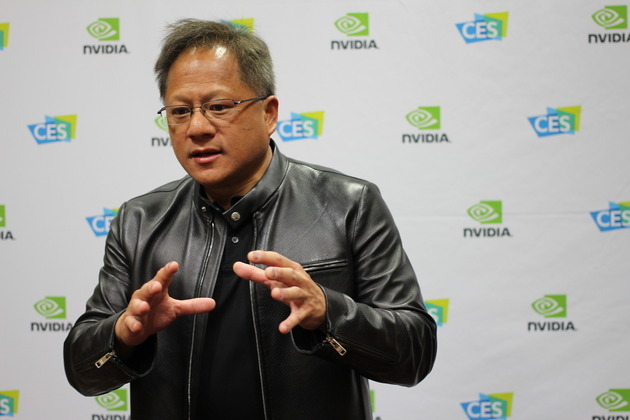

Nvidia CEO in Taipei to thank TSMC, discuss successor to H20 chip

TAIPEI, Taiwan: Nvidia CEO Jensen Huang arrived in Taipei for a brief visit with executives at chipmaking partner Taiwan Semiconductor...

Weak start to week for Wall Street, Dow slides 349 points

NEW YORK, New York - U.S. investors and traders were pessimistic in their views on Monday. The broader market was weaker with the Dow...